#ACT EXPO 2019 ANAHEIM FLOOR PLAN FULL#

Tesla says the Semi is available in versions ranging from 300 to 500 miles with a full charge and fully loaded. Typically, that’s an industry term for a model that’s not yet a commercial product. In the company’s latest 10-Q filing with the SEC, a sole reference to Semi in the 34-page document lists it as being in “pilot production” at the Nevada Gigafactory. Tesla also didn’t provide Semi production and sales details at its March 1 investor conference or its April 19 quarterly results call. The company didn’t respond to a request for comment on its Semi program and estimated sales this year. UPS said it’s in talks with Tesla and hopes to start getting them in 2024. Hunt told Forbes they don’t know when they’ll start receiving trucks. Nearly six years later, they’re still waiting. Shortly after the Semi was unveiled at a splashy event in Los Angeles in November 2017, numerous companies with big truck fleets announced plans to buy thousands of units.

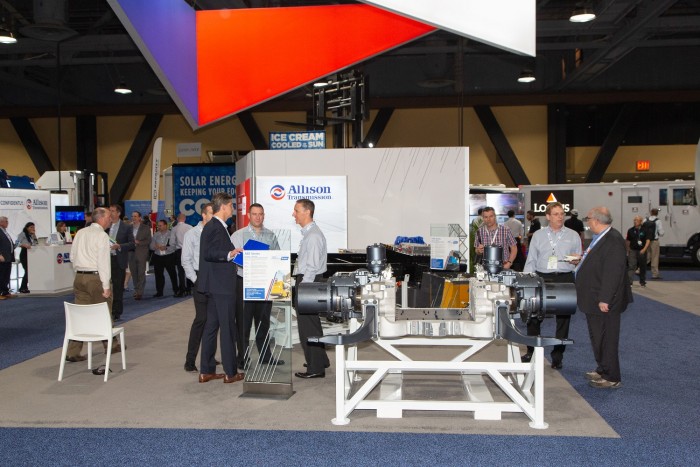

Of that figure, most were made by China’s BYD none were Teslas.ĭan Priestly, left, senior manager for the Tesla Semi program and Elon Musk discuss the trucks features in December 2022. for electric vehicle sales, recorded only 134 sales of battery semis in 2022. Still, early indications show it’s behind its competitors in the nascent field - despite Musk’s bluster. Tesla had a chance to dominate the new electric truck space in the same way it’s led in battery-powered passenger vehicles. The push for non-polluting trucks will go beyond California as more than a dozen states, including New York and Washington, follow its strict air pollution rules and may adopt similar truck regulations. That would be a market worth more than $40 billion a year. By the mid-2030s, as battery and hydrogen trucks reach cost parity with diesel models, they’ll dominate heavy-duty market sales, accounting for more than 200,000 units annually, according to a National Renewable Energy Laboratory study. A survey of fleet operators by researcher Gladstein, Neandross & Associates presented at ACT Expo last week found that orders for electric semi trucks currently total just 6,000 units over the next few years, worth about $1.5 billion, from essentially zero last year. Just how fast sales will grow, however, isn’t clear. The market for battery- and hydrogen trucks is getting a push as California is barring new diesel commercial vehicles from being sold in the state by 2036 and allowing only zero-emission models by the mid-2040s. “It’s still a gorilla in the room, but it's markedly more diminutive than it was.” “For what was at one time seen as the 800-pound gorilla in the room, I mean, it’s still a gorilla in the room, but it's markedly more diminutive than it was.”

“One of the things that's been quite remarkable about this show is the absolute lack of commentary on the Tesla product,” said Oliver Dixon, senior analyst for heavy trucks at researcher Guidehouse. Not because it doesn’t qualify but because the company hasn’t even registered for the program, according to the Air Resources Board. Tesla, whose CEO has notoriously rarely met a government incentive he didn’t like, is leaving money on the table: Tesla Semi isn’t listed among the zero-emission trucks that qualify for generous incentives from California worth $120,000 for battery-powered semis (and $240,000 for hydrogen models). Even more unusual than the slow sales is–despite the fanfare of its launch–the minimal hype around the truck that Tesla and CEO Musk, with a net worth of $179.3 billion, are known for. It’s also excluded the model from its last two quarterly production reports. To date, however, Tesla (with $81.5 billion of revenue last year) has only delivered about three dozen trucks to one publicly identified customer. The company hopes to produce at least 50,000 of them annually by next year, generating as much as $12.5 billion in revenue based on an estimated price of at least $250,000 per truck. But when it comes to sales, Semi remains a slowpoke.

0 kommentar(er)

0 kommentar(er)